Our Journey: From Idea to Impact

The Founding Vision

Marcus and Sarah met at a financial conference in Vancouver, both frustrated by the gap between institutional-quality research and what individual investors could access. They decided to change that, starting with a simple newsletter analyzing Canadian markets.

Pandemic Pivot

When markets crashed in March 2020, our analysis helped hundreds of investors navigate the chaos. We realized we needed to expand beyond newsletters — people needed real-time guidance during volatile periods. This led to our first comprehensive market analysis platform.

Technical Excellence

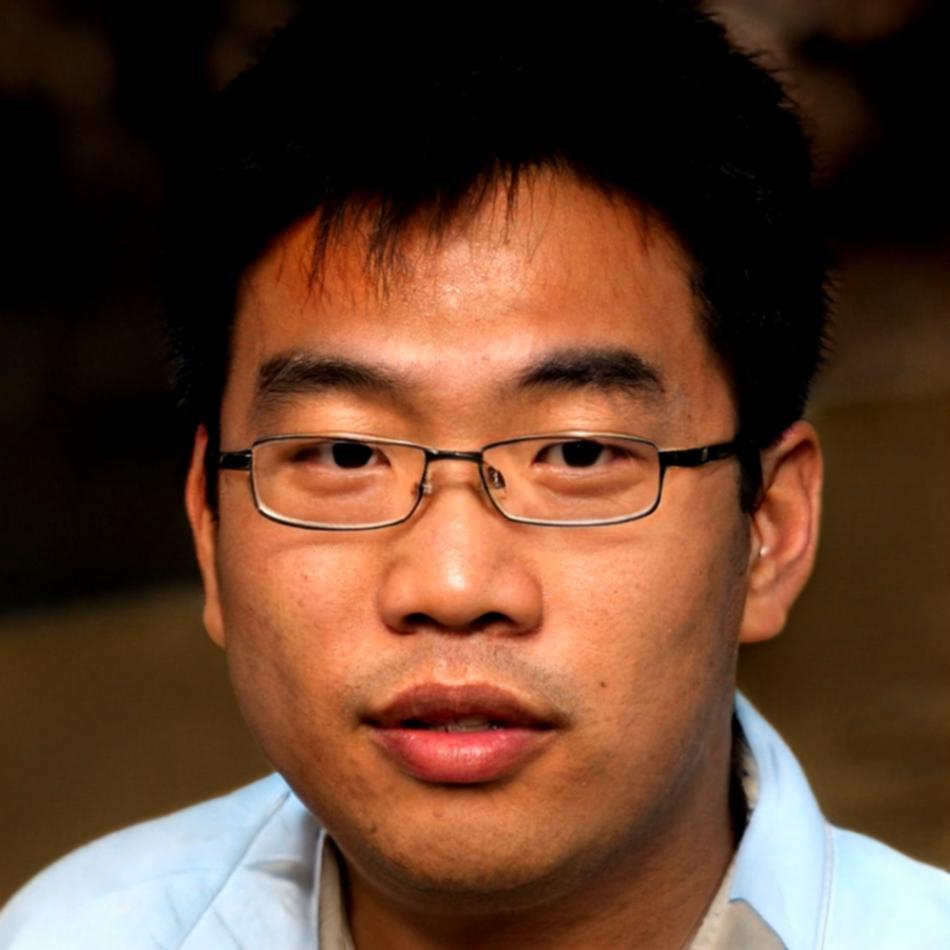

David joined our team, bringing sophisticated technical analysis capabilities. His algorithms helped us identify the 2022 bear market bottom months before traditional indicators confirmed the trend reversal. This marked our evolution into a full-service financial analysis firm.

Educational Expansion

Recognizing that education empowers better investment decisions, we launched our comprehensive learning programs. These courses teach the same analytical techniques we use professionally, adapted for individual investors who want to understand markets at a deeper level.

Future-Focused Innovation

Today, we're pioneering new approaches to market analysis, incorporating AI-assisted research while maintaining the human insight that makes our work valuable. Our goal remains unchanged: democratizing access to institutional-quality financial analysis for Canadian investors.